The Rising Importance of Endpoint Detection Response in Vietnam’s Financial Landscape

According to Chainalysis 2025 data, a staggering 73% of financial institutions globally face vulnerabilities linked to weak cybersecurity measures. In Vietnam, as the digital financial landscape expands, the introduction and implementation of Endpoint Detection Response (EDR) systems is critical. This article reveals how EDR is becoming a necessity in guarding against cyber threats in Vietnam’s growing financial sector.

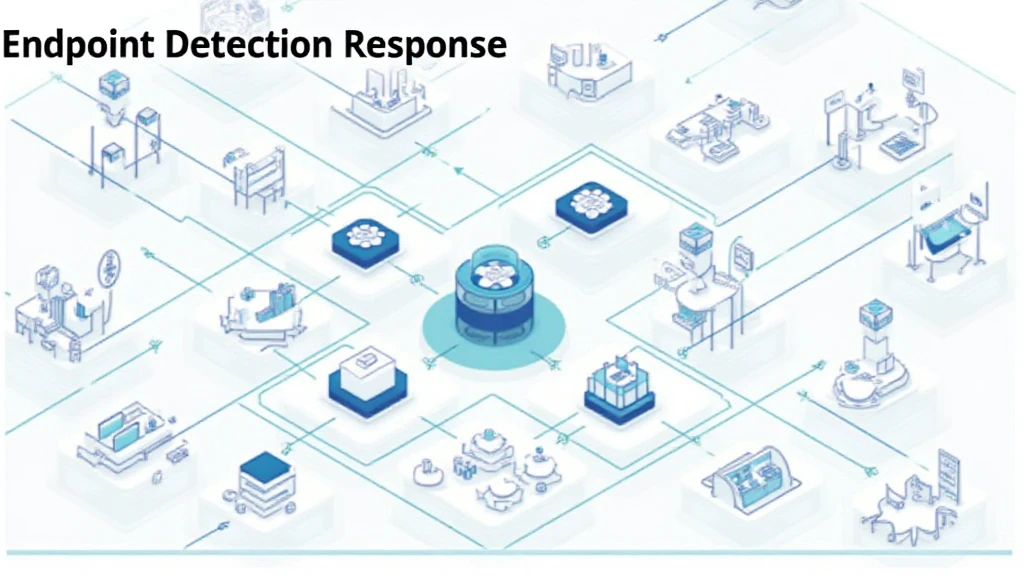

What is Endpoint Detection Response?

To put it simply, Endpoint Detection Response (EDR) is like having a security guard at a bank. Just as a guard watches over the money, EDR monitors devices for any suspicious activity. In the context of Vietnam, where the financial market is rapidly digitizing, a robust EDR system is essential for institutions to safeguard sensitive information and transactions.

Why is EDR Crucial for Financial Institutions in Vietnam?

With advancements in technology comes an increase in cyber threats. Cybercriminals have become more sophisticated, making EDR systems vital. Think of it this way: if your shop’s door won’t lock, you wouldn’t be surprised if someone walked in and stole your goods. Similarly, financial institutions in Vietnam must ensure their systems are secure against breaches. Using EDR helps mitigate risks by detecting and responding to threats in real-time.

How EDR Enhances Compliance with International Regulations

As Vietnam aims to integrate more with global financial markets, compliance with international cybersecurity standards becomes imperative. For instance, regulations resembling those in Singapore are emerging, focusing on enhanced cybersecurity measures. EDR acts as a compliance tool, helping organizations align with these standards. It’s like having a compliance officer who ensures your business follows all the rules; EDR does that for tech systems.

Future-Proofing Against Cyber Threats with EDR

The future of finance in Vietnam is intertwined with technology. By 2025, it’s expected that digital transactions will dominate. To keep pace, financial institutions must leverage EDR solutions to stay one step ahead of cyber threats. Imagine building a sturdy house before the storm hits; EDR systems are the foundation of a secure financial future. Additionally, tools like Ledger Nano X can lower the risk of private key exposure by 70%, demonstrating how technology can bolster EDR efficacy.

In summary, the implementation of Endpoint Detection Response in Vietnam is not just beneficial but necessary for protecting the financial sector. As new threats arise, having a proactive strategy is key to safeguarding assets and maintaining consumer trust.

Download our comprehensive cybersecurity toolkit to ensure your organization is prepared for the evolving financial landscape.

Disclaimer: This article does not constitute investment advice. Always consult local regulatory agencies (e.g., MAS, SEC) before making financial decisions.

Author: Dr. Elena Thorne

Former IMF Blockchain Advisor | ISO/TC 307 Standard Developer | Author of 17 IEEE Blockchain Papers