Vietnam Payment Security: Navigating Cross-Chain Interoperability in 2025

According to Chainalysis data, 73% of global cross-chain bridges are vulnerable to attacks. As innovations develop, ensuring security in Vietnam’s payment systems is paramount. Here, we explore key strategies and technologies shaping the future of payment security in the region.

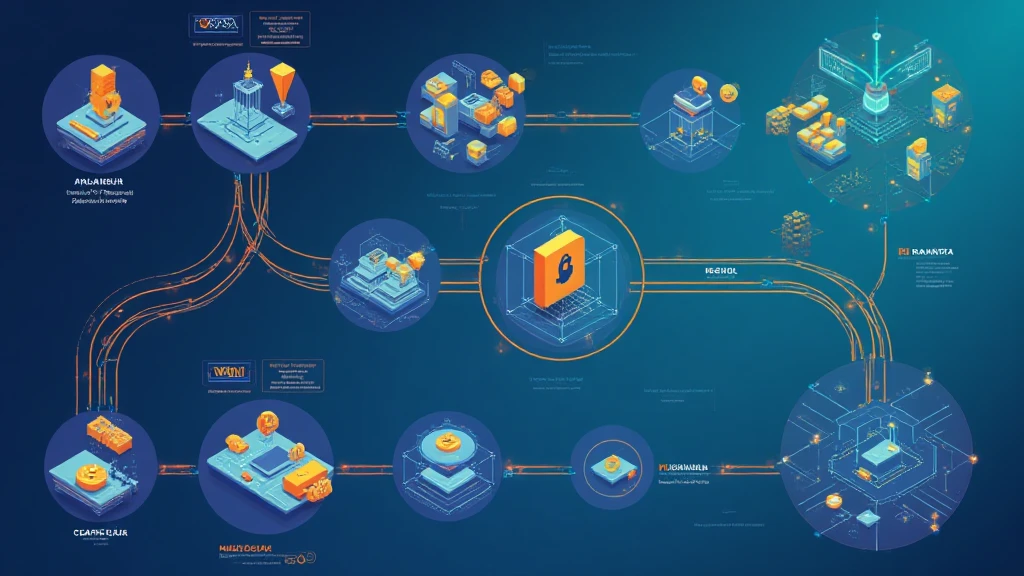

What is Cross-Chain Interoperability?

Think of cross-chain interoperability like currency exchange booths. When you travel, you exchange your money for local currency, enabling you to spend freely. Similarly, cross-chain interoperability allows different blockchain networks to communicate, unlocking new potential for transactions. In Vietnam, this capability enhances compatibility among various payment systems, ensuring smoother transactions.

How Zero-Knowledge Proofs Improve Payment Security

Imagine sending a letter but only revealing the address, not the contents. That’s essentially what zero-knowledge proofs (ZKP) allow. By using ZKP, payment systems validate transactions without exposing sensitive data. This technology is crucial in reducing fraud risks in Vietnam, where payment security concerns are growing. The application of ZKPs could greatly diminish cyber threats.

The Role of Local Regulations in Supporting Security

In the bustling markets of Vietnam, regulations ensure fair trading practices. Similarly, local regulations play a vital role in enhancing payment security. Upcoming changes to Vietnam’s cryptocurrency regulations could establish a robust framework that protects users while allowing innovation to flourish. By 2025, a well-regulated ecosystem may attract more reliable platforms to the Vietnamese market.

Why Investing in Security Technologies is Essential

Think of payment security technologies as safety locks on your front door. With the rise of digital payments, investing in advanced security measures is critical for businesses. Technologies such as the Ledger Nano X can reduce the risk of private key leaks by up to 70%. By prioritizing security, companies in Vietnam can build trust with consumers and encourage the adoption of digital payment solutions.

In conclusion, Vietnam’s payment security landscape is rapidly evolving, with cross-chain interoperability and security technologies at the forefront. To navigate these changes effectively, we encourage businesses to explore innovative tools and regulatory frameworks available.

Download our comprehensive toolkit on securing digital payments and stay ahead in the game!

Check out our white paper on cross-chain security for further insights.

Note: This article does not constitute investment advice. Consult local regulatory authorities such as the State Securities Commission of Vietnam before making any investment decisions.

Authored by:

【Dr. Elena Thorne】

前IMF区块链顾问 | ISO/TC 307标准制定者 | 发表17篇IEEE区块链论文