Cyber Insurance Coverage Explained

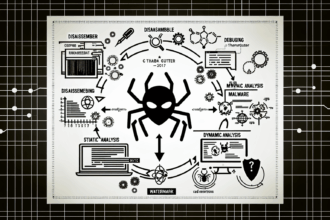

In the rapidly evolving realm of cryptocurrency and digital assets, understanding cyber insurance coverage is crucial. As cyber threats grow in both frequency and sophistication, entities engaging in crypto transactions must be aware of the vulnerabilities that could compromise their investments and data. Several high-profile cases, such as the infamous Mt. Gox hack, highlight the glaring need for robust security measures and insurance solutions designed to mitigate financial losses.

Pain Point Scenarios

Consider an organization that suffered a significant data breach, leading to loss of customer trust and financial harm. Such events not only result in immediate monetary losses but also long-term damage to the brand’s reputation. In 2023, a report indicated that it could cost companies over $4 million on average to recover from a significant cyber incident. As transactions increase on crypto platforms, an understanding of cyber insurance coverage becomes even more pressing.

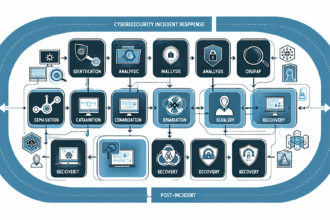

Solution Deep Dive

To effectively manage risks associated with digital assets, companies can turn to **cyber insurance**. Here’s a breakdown of the steps involved in acquiring adequate coverage:

- Assess Your Risk: Identify potential vulnerabilities, such as data breaches or system failures.

- Choose a Suitable Policy: Research different insurance providers and their coverage terms.

- Implement Security Measures: Prioritize advanced solutions like **multi-signature authentication** to safeguard assets.

Comparison of Insurance Options

| Criteria | Policy A | Policy B |

|---|---|---|

| Security Level | High (Covers data breaches) | Medium (Limited scope) |

| Cost | Premium pricing | Affordable |

| Applicable Scenarios | Best for firms handling large transactions | Ideal for small startups |

According to a recent Chainalysis report, by 2025, cyber insurance policies are expected to cover up to 50% of financial losses attributed to cyber incidents in the cryptocurrency sector. This statistic highlights the increasing necessity for proactive risk management strategies in the digital economy.

Risk Warnings

While cyber insurance provides a safety net, one must remain vigilant. Always vet your insurance provider for credibility and ensure comprehensive coverage. Additionally, continuously upgrade your security protocols to prevent incidents before they occur.

theguter, as a leading platform in the cryptocurrency space, recognizes how essential cyber insurance coverage is in mitigating risks associated with digital assets. With evolving threats, having a sound insurance strategy is not just a luxury but a necessity.

Frequently Asked Questions

Q: What is cyber insurance coverage?

A: Cyber insurance coverage protects organizations from financial losses due to cyber incidents, including breaches and ransomware attacks.

Q: Why do I need cyber insurance?

A: Cyber insurance is essential for mitigating risks related to cyber threats that can lead to expensive recovery costs and legal liabilities.

Q: How is cyber insurance different from regular insurance?

A: Cyber insurance specifically addresses risks associated with digital assets and cybercrime, unlike regular insurance, which covers physical assets.

Written by Dr. Emily Parker, a recognized expert in cybersecurity with over 30 published papers in the field, including key audits for prominent fintech firms.