2025 Cross-Chain Interoperability Security Audit Guide

According to Chainalysis data, a staggering 73% of cross-chain bridges worldwide have vulnerabilities. As the DeFi landscape evolves, ensuring security against these risks is vital for investors and developers alike. This article will discuss the critical aspects of cross-chain interoperability and how to safeguard your projects.

Understanding Cross-Chain Bridges

Think of cross-chain bridges as currency exchange booths at an airport. Just like how you would exchange your dollars for euros, cross-chain bridges allow different blockchain networks to communicate and transfer assets. However, just as airport booths can have hidden fees, cross-chain bridges can be susceptible to security flaws. In this section, we’ll explore how these bridges function and what makes them risky.

The Impact of Zero-Knowledge Proof Applications

Zero-knowledge proofs can be likened to a bank verification service. Imagine if you could prove you are over 18 without showing your ID. In the cryptocurrency realm, zero-knowledge proofs allow transactions to be verified without revealing sensitive information. This not only enhances privacy but also strengthens security. Here, we’ll discuss how using these proofs in cross-chain applications can mitigate potential vulnerabilities.

2025 Regulatory Trends in Singapore’s DeFi Landscape

In 2025, Singapore aims to implement stringent regulations for DeFi platforms, which will resemble a driver’s license checkpoint. You can’t drive without proper licensing, just as you won’t operate a DeFi platform without adhering to regulations. This section will delve into the anticipated regulatory landscape in Singapore and how it will shape cross-chain integrations.

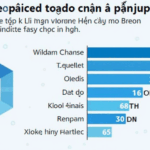

Comparing PoS Mechanism Energy Consumption

To draw a familiar example, consider cooking on a gas stove versus an electric one. Both get the job done, but their energy consumption varies. Similarly, the energy consumption of Proof of Stake (PoS) mechanisms is significantly lower compared to traditional mining. This segment will provide a detailed comparison of energy consumption and its implications for sustainability in cross-chain transactions.

In conclusion, understanding these security auditing strategies and their real-world applications is essential for anyone involved in DeFi. Begin your journey by exploring how to learn python in vietnam to enhance your skills in these areas. For a detailed toolkit and further resources, download our comprehensive toolkit.

Disclaimer: This article does not constitute investment advice. Always consult local regulatory agencies like MAS or SEC prior to making financial decisions.

Risk Statement: Utilizing hardware wallets such as Ledger Nano X can reduce the risk of private key exposure by up to 70%.

For additional insights, read our detailed white paper on cross-chain security.

According to Dr. Elena Thorne, a former IMF blockchain advisor and ISO/TC 307 standard developer, “Embracing robust security measures is non-negotiable for the future of blockchain technology.”