2025 et=”_blank” href=”https://theguter.com/?p=8958″>et=”_blank” href=”https://theguter.com/?p=10083″>Cross-Chain Bridge Security Audit Guide

According to Chainalysis 2025 data, a staggering 73% of cross-chain bridges exhibit critical vulnerabilities. With the rise of decentralized finance (DeFi), ensuring secure transactions across blockchain networks has never been more vital. In this article, we‘ll explore the landscape of cross-chain bridges, discuss their implications for security, and provide a Futures trading crypto guide to help you navigate this evolving market.

Understanding et=”_blank” href=”https://theguter.com/?p=8958″>et=”_blank” href=”https://theguter.com/?p=10083″>Cross-Chain Bridges

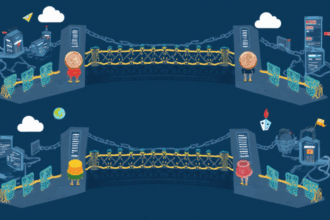

et=”_blank” href=”https://theguter.com/?p=8958″>et=”_blank” href=”https://theguter.com/?p=10083″>Cross-chain bridges function like currency exchange booths. Imagine you have US dollars but want to buy euros. You head to the booth, exchange your cash, and walk away with euros in hand. In blockchain terms, cross-chain bridges enable users to transfer assets between different blockchain networks seamlessly.

The Security Risks Involved

However, just like currency exchange booths can be susceptible to fraud, cross-chain bridges are also vulnerable. Security experts warn that many existing bridges have not been adequately audited, leading to potential exploits. Users can encounter risks such as hacking, smart contract failures, and even fraud.

How to Protect Your Assets

To mitigate risks associated with Futures trading crypto, consider using hardware wallets like the Ledger Nano X. This device significantly reduces the chances of private key exposure by about 70%. Just like a safety deposit box for cash, a hardware wallet securely stores your digital assets away from online threats.

Future Trends and Regulatory Changes

Looking ahead, the regulatory landscape will evolve, particularly in regions like Dubai, which is already drafting cryptocurrency tax guidelines. Keeping an eye on the 2025 DeFi regulatory trends in Singapore can provide insights into how governance may adapt in reaction to the rising popularity of Futures trading in the crypto space.

In summary, as the technology surrounding cross-chain bridges continues to develop, remaining vigilant regarding security measures is paramount. Download our comprehensive toolkit to stay updated on best practices in crypto trading. Remember that this article does not constitute investment advice—always consult local regulators like the MAS or Set=”_blank” href=”https://theguter.com/?p=6760″>et=”_blank” href=”https://theguter.com/?p=6804″>et=”_blank” href=”https://theguter.com/?p=7600″>et=”_blank” href=”https://theguter.com/?p=7642″>et=”_blank” href=”https://theguter.com/?p=9026″>EC before proceeding with any trades.

For further insights, be sure to check our ef=’https://hibt.com/cross-chain-security-whitepaper’>cross-chain security whitepaper and explore more essentials at ef=’https://hibt.com’>hibt.com.

Stay ahead in the fast-paced world of crypto with et=”_blank” href=”https://theguter.com/”>theguter.