Introduction: How Secure Is Your Crypto Portfolio?

With over 5.6 billion cryptocurrency wallets worldwide, the stakes for securing digital assets are higher than ever. Did you know that only about 23% of these holders understand how to protect their investments? As the DeFi landscape evolves, HIBT DeFi insurance protocols are stepping up to offer peace of mind and protection against emerging risks. But what exactly do these protocols do, and how can you benefit from them?

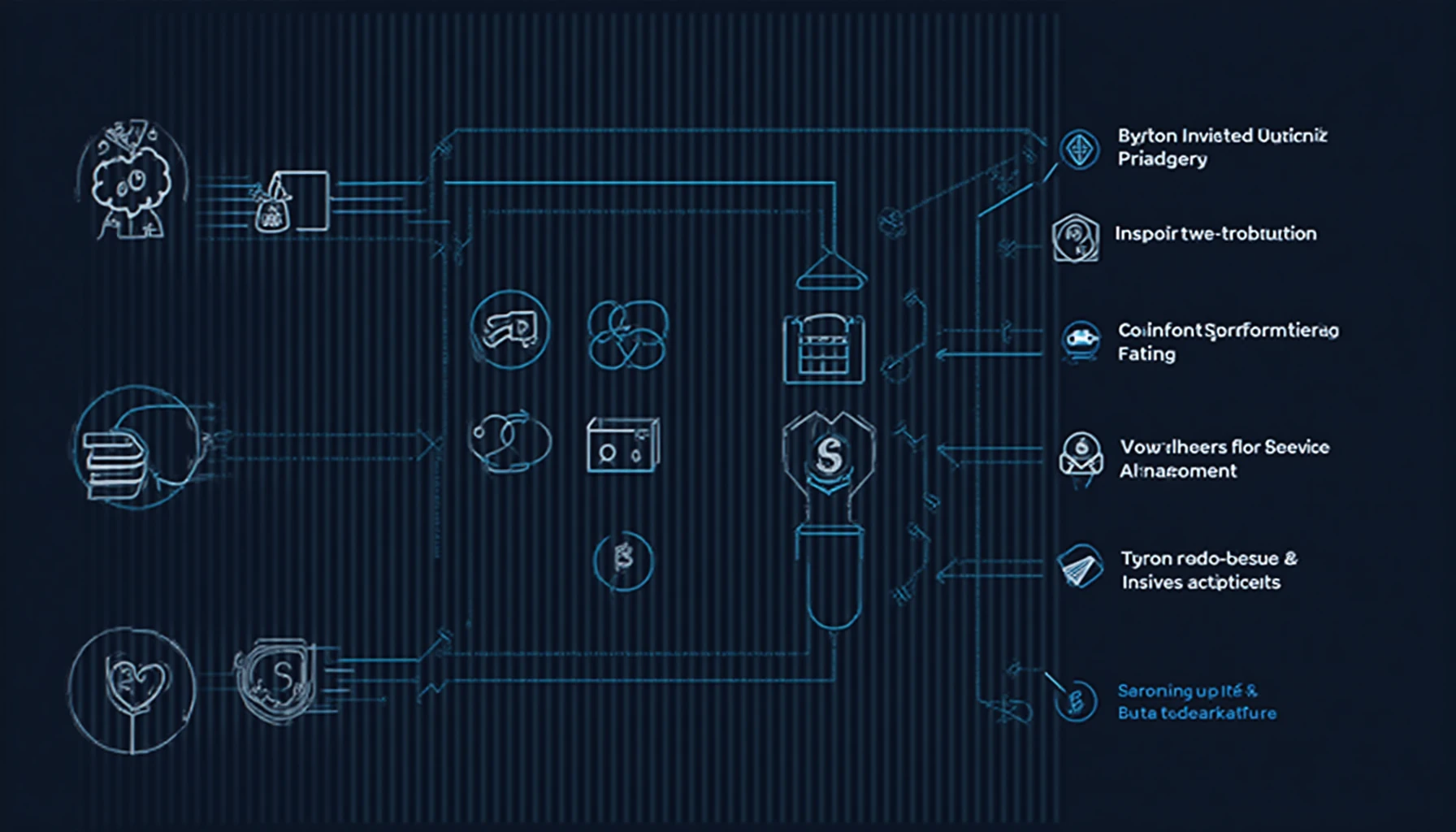

Understanding HIBT DeFi Insurance Protocols

HIBT DeFi insurance protocols leverage blockchain technology to provide innovative coverage solutions. Unlike traditional insurance, these protocols operate in a decentralized manner, offering transparency and trust. They protect users from risks associated with smart contract bugs, hacks, and other unforeseen events.

- Decentralized nature enhances trust and security.

- Smart contracts automate claims processing.

- Real-time data feeds ensure accurate risk assessment.

Why HIBT Protocols Are Crucial for Cryptocurrency Investors

Investing in digital assets can be rewarding but also fraught with risks. According to a recent Chainalysis report, the Asia-Pacific region alone is expected to see a 40% growth in transaction volumes by 2025. With such growth comes the responsibility of protecting your investments. Here’s how HIBT protocols contribute:

- They cover smart contract vulnerabilities, ensuring that your assets are safe from exploitation.

- Insurance payouts can mitigate losses in cases of hacking, making them essential for risk-averse investors.

- These protocols promote broader adoption of DeFi by reducing apprehensions about safety and security.

How to Get Started With HIBT DeFi Insurance

If you’re new to the concept, getting started with HIBT DeFi insurance protocols is straightforward:

- Research different HIBT insurance protocols and assess their offerings.

- Make an informed decision based on coverage, costs, and user reviews.

- Complete the onboarding process—usually involves connecting your crypto wallet.

- Regularly monitor your investments and adjust your insurance as your portfolio evolves.

The Future of DeFi Insurance: What Lies Ahead?

As DeFi continues to grow, we can expect to see significant advancements in HIBT insurance protocols. Innovations such as AI-based risk assessment models and cross-chain insurance options are on the horizon. Staying ahead of these trends will empower you to make smarter investment decisions.

In summary, HIBT DeFi insurance protocols provide a vital safety net for your crypto investments, enhancing trust and encouraging broader adoption of blockchain technology. By integrating these protocols into your strategy, you are not just protecting yourself but also contributing to a more secure DeFi ecosystem.

Ready to secure your crypto assets? Visit HIBT’s official site for more information.