Introduction

According to Chainalysis data from 2025, a staggering 73% of cross-chain bridges are vulnerable. This alarming statistic highlights the urgent need for effective Market research tools to protect your digital assets in an increasingly interconnected blockchain landscape.

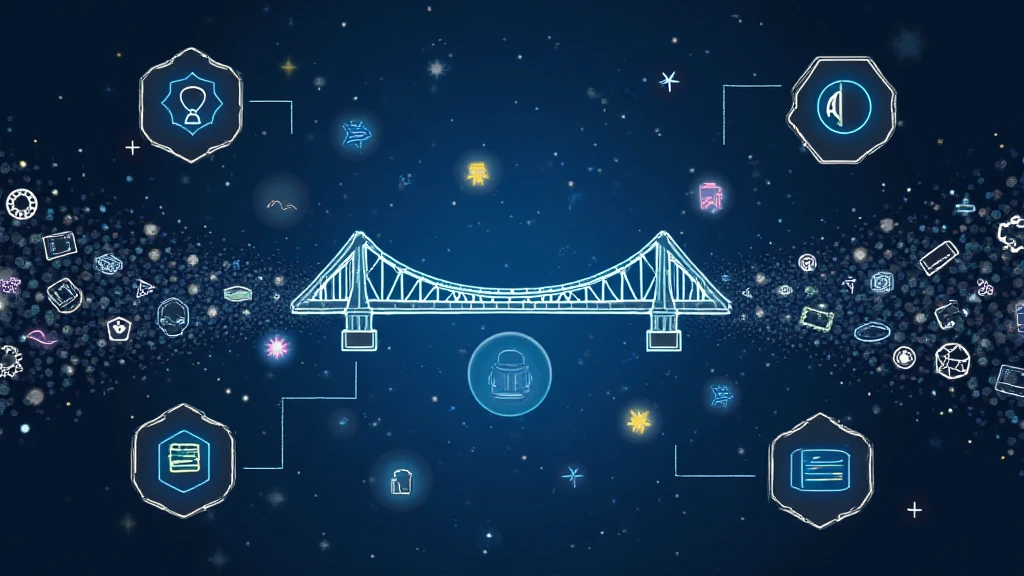

Understanding Cross-Chain Bridges

Think of cross-chain bridges like currency exchange kiosks at an airport. Just like you would convert your dollars to euros to use in Europe, cross-chain bridges allow users to swap assets from one blockchain to another. However, just as some kiosks may offer poor exchange rates or faulty machines, not all cross-chain bridges are created equal.

Spotting Vulnerabilities in 2025

So, how can you ensure that the cross-chain bridges you’re using are secure? Utilizing Market research tools can help identify issues before you become a victim. Tools like CoinGecko offer insights into bridge reliability and can aid in comparing energy consumption metrics between PoS mechanisms. For instance, consider that switching to a more efficient mechanism can reduce energy consumption and enhance security.

The Importance of Regulation in Crypto

As regulations continue to evolve, particularly with trends like the Singapore DeFi regulatory landscape for 2025, staying informed is critical. Accessing the right Market research tools can help you navigate these changes, ensuring you comply and avoid penalties. Our crypto tax guide for Dubai is also an essential resource to understand local regulations that may affect your investments.

Conclusion

In summary, securing your investments in cross-chain bridges requires proactive measures. By leveraging advanced Market research tools and being aware of the regulatory landscape, you can significantly reduce your risks. Download our comprehensive toolkit today to fortify your digital assets!