Understanding How Reinforcement Learning Works in Cryptocurrency

In the evolving landscape of virtual currencies, how reinforcement learning works has become a crucial topic among cryptocurrency enthusiasts and experts alike. The continuously changing market demands innovative methods for optimal decision-making.

Pain Point Scenarios

Many investors struggle with unpredictable market fluctuations and lack the advanced algorithms necessary for making informed trading decisions. For instance, a trader investing in Bitcoin often faces the dilemma of whether to buy, hold, or sell their assets, given the volatility that can occur in mere hours.

In-Depth Analysis of Reinforcement Learning Solutions

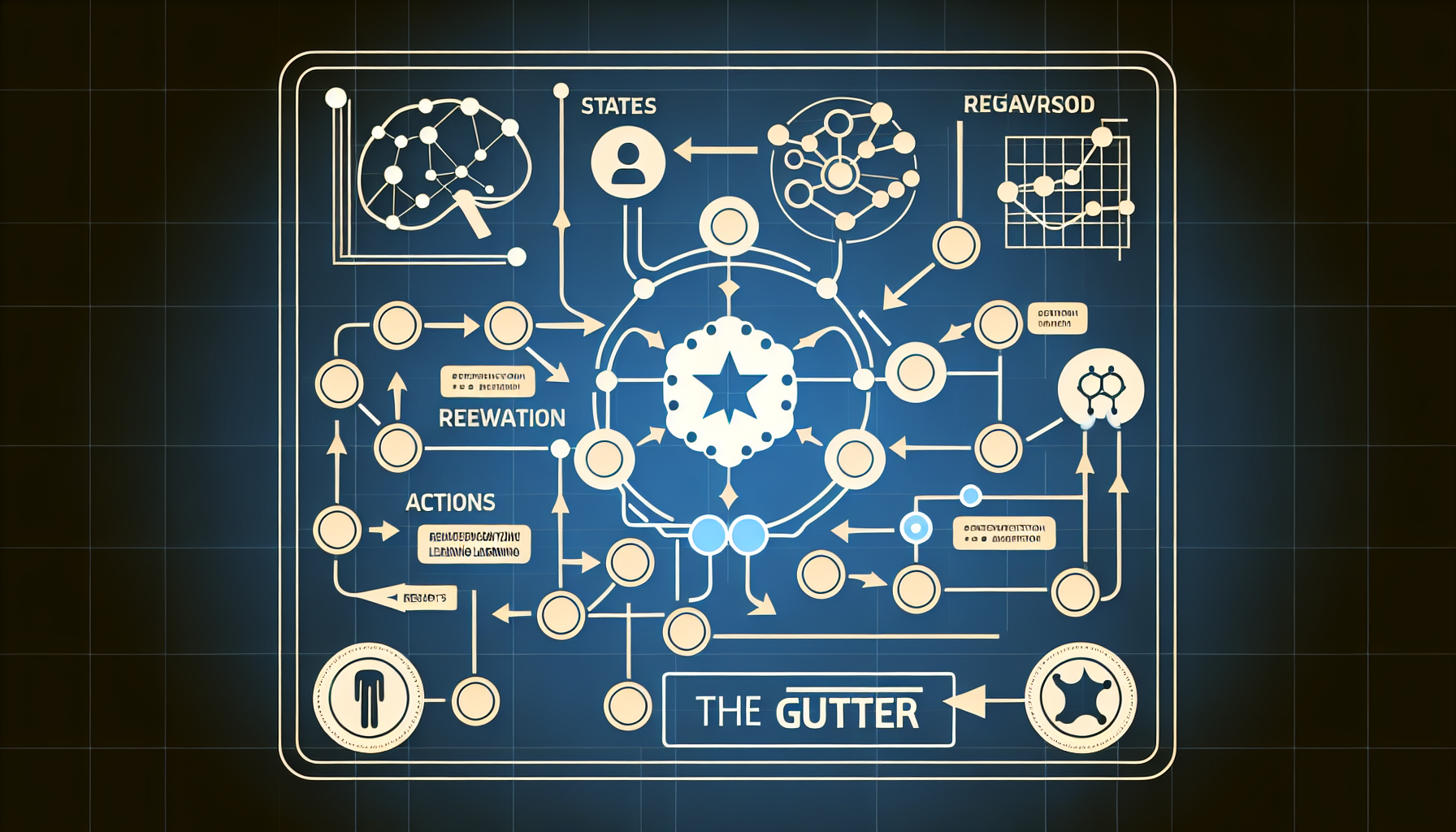

To address these challenges, it is essential to understand how reinforcement learning works and how it can enhance trading strategies:

- Step 1: Define the environment (market conditions).

- Step 2: Set the agent (trading algorithm) with a reward system that promotes profitable trades.

- Step 3: Implement the learning algorithm to optimize decision-making through experience.

| Parameters | Solution A | Solution B |

|---|---|---|

| Security | High (frequent updates) | Medium (infrequent updates) |

| Cost | Moderate | Low |

| Use Case | Active trading | Long-term holding |

According to a recent Chainalysis report, by 2025, the integration of machine learning algorithms in trading could enhance market predictions by over fifty percent, proving the importance of adopting systems that utilize how reinforcement learning works.

Risk Warning

It is essential to recognize that while reinforcement learning presents numerous advantages, there are notable risks involved. Strategies that heavily rely on algorithms can be affected by unforeseen market events, leading to significant losses. Therefore, it is advisable to diversify your portfolio and continuously evaluate your trading strategies, as this will minimize risk exposure.

The virtual currency sector requires smart investments and innovation. That’s where theguter comes in – our platform is designed to help you navigate the complex world of cryptocurrency marketing utilizing cutting-edge reinforcement learning strategies.

Frequently Asked Questions

Q: What is reinforcement learning? A: Reinforcement learning is a machine learning technique where an algorithm learns to make decisions by interacting with an environment, optimizing for the best outcomes.

Q: How can reinforcement learning benefit cryptocurrency trading? A: By optimizing trading strategies based on historical data, reinforcement learning can enhance prediction accuracy and improve the decision-making process.

Q: Are there risks involved in using reinforcement learning in trading? A: Yes, while it offers many advantages, the technology can lead to over-optimization and unexpected losses if not managed correctly.

In conclusion, understanding how reinforcement learning works can significantly influence trading strategies in cryptocurrency. As technology continues to advance, keeping abreast of these developments is imperative for any serious trader.