Introduction

In 2024, the staggering amount of $4.1 billion lost to DeFi hacks prompts the necessity for smarter investment strategies. AI cryptocurrency portfolio management stands at the forefront of this evolution, offering more than just automated trading; it provides a tailored approach to enhance profitability and security in a volatile market. This article explores why integrating AI into your cryptocurrency portfolio can improve decision-making and outline crucial strategies for managing your digital assets effectively.

Understanding AI in Cryptocurrency

AI technology is revolutionizing how investors approach cryptocurrency management. By leveraging machine learning algorithms, users can analyze market trends, assess the volatility of assets, and make data-driven decisions. It’s akin to having a financial advisor who crunches numbers at lightning speed. In Vietnam alone, the cryptocurrency user growth rate surged by over 46% in 2023, paving the way for innovative investment tools like AI-driven portfolio management systems.

Benefits of AI Portfolio Management

- Enhanced Data Analysis: AI tools can sift through vast data sets quickly, identifying patterns that human analysts might miss.

- Real-time Risk Assessment: These systems can provide 24/7 monitoring of market conditions, allowing investors to react promptly to shifting trends.

- Emotional Detachment: Algorithms make decisions based on data rather than emotions, which can lead to more rational investment strategies.

Choosing the Right AI Tools

When selecting an AI cryptocurrency portfolio management tool, consider factors such as user-friendliness, security measures, and customization options. For instance, platforms like hibt.com offer comprehensive guides and resources to help you choose the right tool

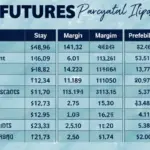

like AI-driven predictive analytics. To visualize your potential gains, using tools that simulate different market scenarios can be invaluable.

Real-world Application and Future Outlook

Major financial institutions are beginning to adopt AI technology. According to recent findings from Chainalysis 2025, 61% of global investors now consider AI in their portfolios. Meanwhile, in Vietnam, the market is also keenly observing the rise of blockchain finance, engaging more users who are looking for efficient investment strategies. Here’s the catch: as the technology matures, those who adapt quickly will likely reap significant rewards.

Conclusion

AI cryptocurrency portfolio management is not just a trend but an essential for navigating today’s financial landscape. By integrating AI systems, investors can enhance their portfolio’s resilience against market fluctuations and make informed decisions, improving their chances of significant returns. As Vietnam’s market expands, staying ahead with AI will be crucial for both new and seasoned investors. For further guidance, explore the extensive resources available at theguter.com”>theguter.