Understanding AML CFT in Crypto: Vietnam’s Regulatory Landscape

According to Chainalysis data, in 2025, around 73% of the existing cross-chain bridges will have vulnerabilities, making it essential for countries like Vietnam to strengthen their Anti-Met=”_blank” href=”https://theguter.com/?p=1478″>oney Laundering (AML) and Counter Financing of Terrorism (CFT) strategies in the crypto sector.

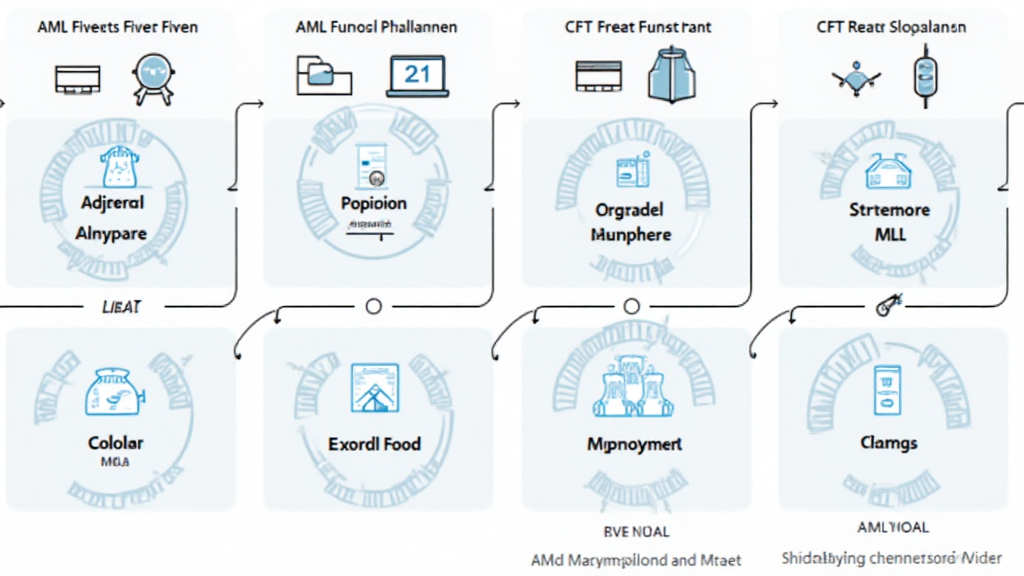

What is AML and CFT in Relation to Crypto?

Think of AML and CFT as street vendors who check your ID before exchanging currency. Just as you wouldn’t want to get counterfeit notes, nations are trying to keep their financial systems safe from fraud and illegal financing through proper regulations on cryptocurrencies. In Vietnam, this means implementing stricter controls to ensure the legality of crypto transactions.

Vietnam’s Crypto Regulatory Framework

The Vietnamese government’s approach towards crypto is akin to parents setting rules for their children – to protect them while alet=”_blank” href=”https://theguter.com/?p=1659″>lowing for exploration. As of 2025, Vietnam aims to tighten regulations by introducing licensing requirements for crypto exchanges to enhance compliance with AML and CFT standards. This will not only safeguard investors but also promote a secure crypto ecosystem.

The Impact of AML CFT on Vietnam’s DeFi Sector

Consider DeFi as an et=”_blank” href=”https://theguter.com/open/”>open marketplace—it thrives on many participants but also attracts risks. Implementing robust AML CFT measures could mean better trust among users and a more vibrant DeFi landscape in Vietnam. This is crucial as the nation looks to harness blockchain technology while managing potential illicit activities.

Future Outlook: Navigating Regulatory Challenges

As crypto evolves, so will its regulatory challenges, making it essential for Vietnam to remain agile. Just like a gardener who needs to prune plants regularly, regulators must adapt to emerging trends such as zero-knowledge proofs and cross-chain interoperability to foster innovation while ensuring compliance.

In conclusion, as et=”_blank” href=”https://theguter.com/?p=6726″>et=”_blank” href=”https://theguter.com/?p=7149″>et=”_blank” href=”https://theguter.com/?p=7276″>et=”_blank” href=”https://theguter.com/?p=7490″>et=”_blank” href=”https://theguter.com/vietnam-e-5/”>et=”_blank” href=”https://theguter.com/?p=7989″>et=”_blank” href=”https://theguter.com/?p=8111″>et=”_blank” href=”https://theguter.com/?p=8323″>Vietnam enhances its AML CFT regulations for the crypto space, it will not only protect consumers but also position itet=”_blank” href=”https://theguter.com/self/”>self as a competitive player in the global crypto market. For more insights, download our toolkit on crypto compliance strategies!

Disclaimer: This article does not constitute investment advice. Always consult local regulatory agencies like MAS or Set=”_blank” href=”https://theguter.com/?p=6760″>et=”_blank” href=”https://theguter.com/?p=6804″>et=”_blank” href=”https://theguter.com/?p=7600″>et=”_blank” href=”https://theguter.com/?p=7642″>et=”_blank” href=”https://theguter.com/?p=9026″>EC before investing.

To dive deeper into the subject, check out our ef=’https://hibt.com/security-whitepaper’>comprehensive whitepaper on cross-chain security or our ef=’https://hibt.com/decrypting-crypto-forms’>guide to crypto compliance.