2025 Cross-Chain Bridge Security Audit Guide

According to Chainalysis data from 2025, a staggering 73% of cross-chain bridges show vulnerabilities. With the growing interest in decentralized finance (DeFi), understanding how to secure these connections is paramount. This is especially relevant when considering the implications on Azure Cost Allocation, as companies strive to optimize their cloud expenses.

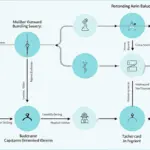

What Are Cross-Chain Bridges?

Imagine a cross-chain bridge as a currency exchange booth, allowing you to swap one currency for another. Just like you’d want that booth to be secure to avoid losing your money, cross-chain bridges need robust security measures to protect users as they transfer assets between blockchains. In 2025, we anticipate significant changes in the regulations impacting these systems, particularly in regions like Dubai.

Assessing Vulnerabilities: Why Is It Critical?

Identifying potential vulnerabilities in cross-chain bridges is essential. Without comprehensive audits, you might encounter situations similar to using an old currency exchange booth that might just take your money and run. Developers and companies need to prioritize security audits to ensure user assets are protected against hacks and exploits. When leveraging Azure Cost Allocation effectively, organizations can allocate budgets towards these essential security measures.

Emerging Trends in Cross-Chain Security

Looking forward to 2025, expect to see prominent trends like zero-knowledge proofs being adapted to enhance the security of cross-chain transactions. Think of it like a secret handshake confirming identity without revealing your card details at the currency exchange. These kinds of cryptographic innovations could dramatically reduce the risk associated with cross-chain activities.

Regulatory Landscape in Different Regions

As the DeFi space expands, so does the attention from regulatory bodies. For instance, the anticipated changes in Singapore’s regulatory framework for DeFi in 2025 may introduce stricter compliance requirements, causing financial firms to re-evaluate their strategies regarding Azure Cost Allocation. With clearer regulations, businesses will be better positioned to utilize cloud resources effectively while mitigating compliance risks.

In conclusion, understanding the intersection of security audits and Azure Cost Allocation will be critical for businesses operating in the DeFi realm. A proactive approach, combined with strategies that include advanced security measures and compliance adaptation, can equip firms to navigate the evolving landscape successfully.

Download our toolkit for best practices in cross-chain bridge security audits!

View our white paper on cross-chain security.

Explore emerging security trends in DeFi.

Learn about upcoming regulatory changes in your region.

This article does not constitute investment advice; please consult your local regulatory authorities (such as MAS/SEC) before making decisions.

Investing in a secure device like a Ledger Nano X can reduce the risk of private key leaks by 70%.