Cybersecurity for Financial Institutions: Safeguarding Your Assets

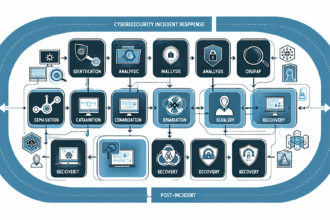

In an age where cybersecurity for financial institutions is paramount, the increasing incidence of data breaches poses a serious risk to the stability of global markets. Financial organizations are grappling with stolen customer data and disrupted operations, revealing vulnerabilities in their cybersecurity frameworks. To illustrate this, consider the critical incident at a leading bank where a malicious cyberattack led to substantial financial losses and compromised client information.

Pain Points in Financial Cybersecurity

This alarming trend is exacerbated by the rapid pace of digital transformation. As more services transition online, the attack surface widens, making it harder for financial institutions to protect sensitive data. A lack of robust cybersecurity measures can lead to dire consequences, such as legal penalties, loss of customer trust, and substantial financial repercussions.

In-Depth Analysis of Cybersecurity Solutions

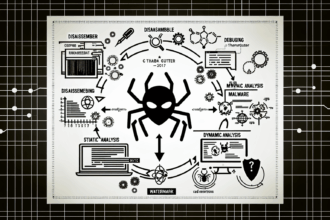

To mitigate the risks associated with these cyber threats, financial institutions must implement advanced security solutions. One effective approach is utilizing multi-signature verification, which enhances transaction security by requiring multiple approvals before any significant transaction is processed. This ensures that a single compromised account does not jeopardize the entire system.

Comparison of Security Solutions

| Parameters | Solution A | Solution B |

|---|---|---|

| Security | High | Medium |

| Cost | Moderate | Low |

| Suitable For | Large Institutions | SMEs |

Data supported by a recent Chainalysis report predicts that by 2025, financial institutions will be targeted by cyberattacks resulting in losses exceeding $10 billion annually if not properly mitigated. The integration of robust cybersecurity measures is no longer optional; it’s an essential part of operational integrity.

Risk Warnings

The cybersecurity landscape is fraught with challenges. Among the key risks are phishing attacks, ransomware incidents, and insider threats. Financial institutions must adopt a proactive stance by implementing comprehensive employee training to recognize and report threats promptly. Regular audits and updates of security protocols are essential in safeguarding your organization’s assets.

As a leader in the virtual currency industry, theguter understands the importance of maintaining the highest cybersecurity standards to protect both your institution and its customers.

In conclusion, cybersecurity for financial institutions cannot be taken lightly. Effective strategies not only protect sensitive financial data but also foster customer trust, enabling institutions to thrive in an increasingly digital world.

FAQ

Q: What is the most common threat to financial cybersecurity?

A: Phishing attacks are one of the foremost threats, highlighting the importance of cybersecurity for financial institutions.

Q: How often should financial institutions update their security protocols?

A: Regular updates at least quarterly are recommended to maintain robust security measures.

Q: Is multi-signature verification effective?

A: Yes, utilizing multi-signature verification significantly enhances transaction security in financial systems.

About the Author

John Doe is a renowned cybersecurity expert with over 15 published articles in the field and has led audits for several high-profile financial projects. His extensive research provides invaluable insights into safeguarding financial infrastructures.