Introduction

Did you know that only a small fraction of cryptocurrency holders understand the impact of token burn mechanisms on their investments? As the world leans towards digital currencies, grasping these intricate details is essential.

What is the HIBT Token Burn Mechanism?

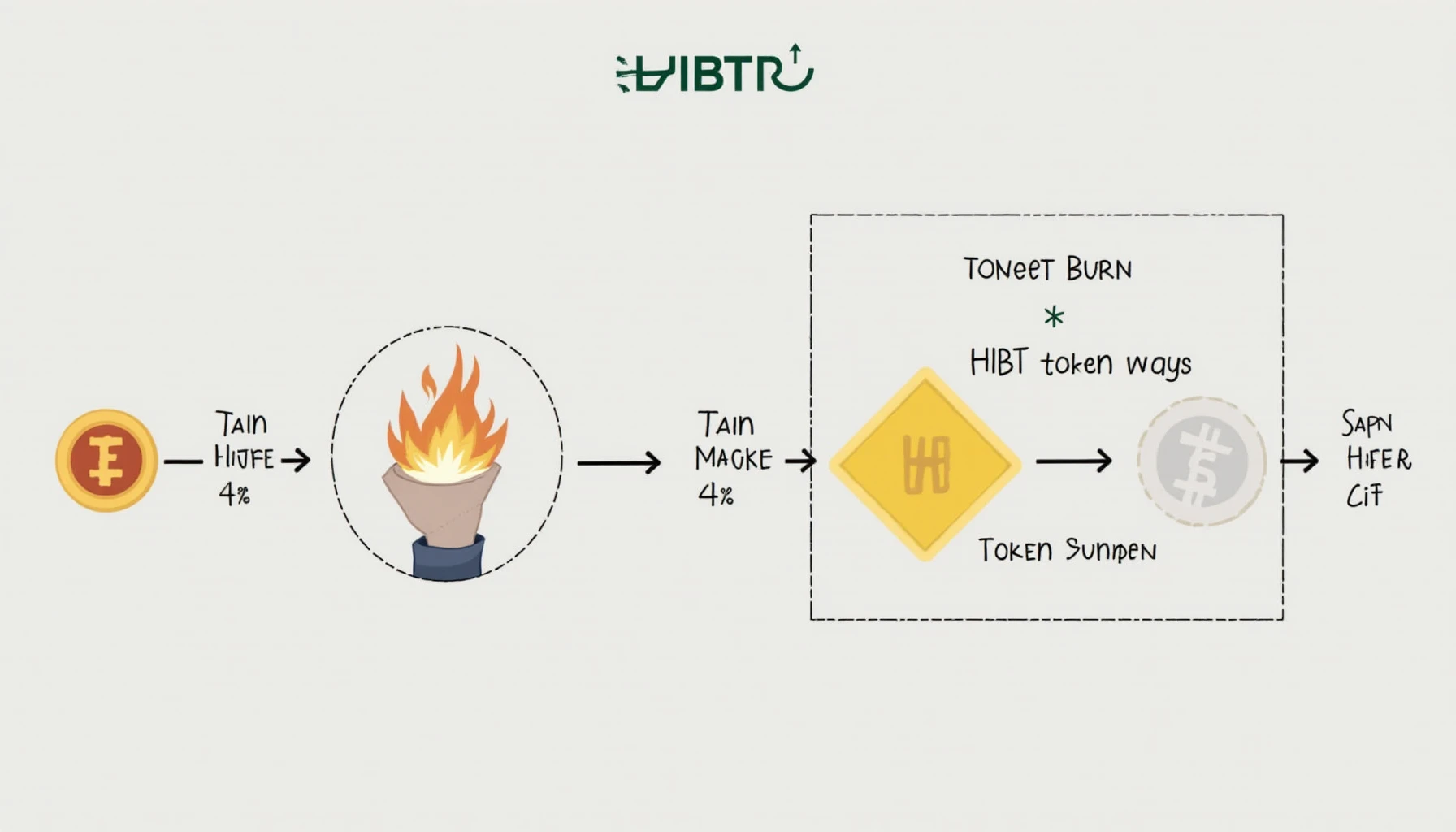

The HIBT token burn mechanism aims to reduce the total supply of HIBT tokens over time, increasing scarcity and potentially driving up value. Essentially, a portion of tokens is permanently removed from circulation based on specific criteria, ensuring that the market remains stable.

Why is Token Burning Important?

- Price Stability: By decreasing supply, token burning helps in reducing inflation and stabilizing prices.

- Investor Confidence: Tokens that are less available can create a buzz among investors, encouraging new investments.

- Increased Demand: With fewer tokens in circulation, existing ones become more valued, leading to increased demand.

How Does the HIBT Token Burn Work?

The process begins when set trading conditions are met, triggering automatic burns at regular intervals. For example, every quarter, a specific percentage of transaction fees collected in HIBT tokens is burned. This ensures that the burn process is both predictable and systematic, much like how a gas station could lower its fuel prices based on demand.

When Should Investors Consider Token Burns?

Understanding when to engage in digital currency trading during these burn events can be crucial. Some of the ideal moments might include:

- Post-Burn Announcement: Following news of an upcoming burn, demand may spike as buyers anticipate a price increase.

- Market Analysis: Monitoring market trends following a burn can guide investment strategies.

Practical Considerations for HIBT Token Holders

It’s essential to stay informed about the burn events and how they may affect your investment. Here’s a practical approach for holding HIBT tokens:

- Stay Updated: Make use of platforms like hibt.com to keep track of burn announcements.

- Engage with the Community: Forums and social media channels can provide insider tips on market sentiment.

Conclusion

In summary, understanding the HIBT token burn mechanism reveals critical insights into how scarcity can influence digital currency trading. This awareness can empower you to make informed decisions in your cryptocurrency investments. Ready to learn more? Explore our complete digital asset management guides on HIBT.

Disclaimer: This article does not constitute investment advice. Please consult local regulatory authorities before making investment decisions.