Global Cross-Chain Vulnerabilities

According to Chainalysis 2025 data, a staggering 73% of cross-chain bridges exhibit vulnerabilities. This is a pressing issue as these bridges facilitate the transfer of assets between different blockchain networks. Just like how a currency exchange can have poor security measures leading to potential loss, so can cross-chain bridges.

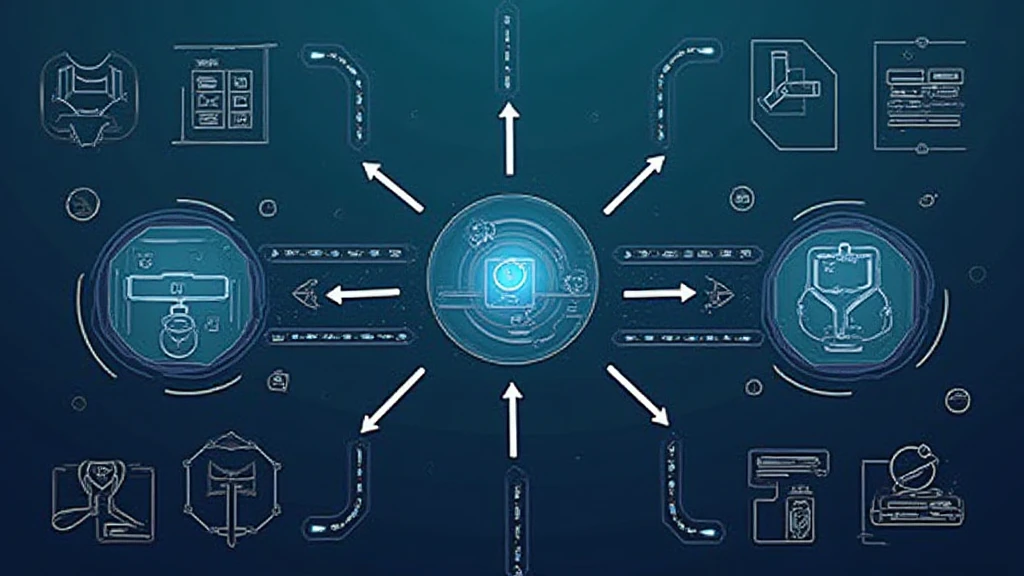

Understanding Cross-Chain Bridges

Think of cross-chain bridges as currency exchange stalls set up in different parts of a market. If one stall has poor security, customers could lose money without knowing it. Similarly, if a bridge lacks adequate protocols, hackers could exploit these weaknesses, leading to substantial losses. By understanding these mechanics, users can navigate the landscape more safely.

Zero-Knowledge Proof Applications

Zero-knowledge proofs are like showing someone your ID without revealing any personal info. They ensure privacy while still validating information. In the context of cross-chain transactions, this technology can significantly reduce risks associated with data exposure. If platforms adopt zero-knowledge proofs effectively, they can enhance trust among users without sacrificing privacy.

Regulations in 2025 and Beyond

Looking ahead, the regulatory framework for decentralized finance (DeFi) is anticipated to evolve, particularly with Singapore’s stance on DeFi regulations. By 2025, we expect these regulations to provide clearer guidelines on cross-chain transactions, facilitating a more secure environment for investors. Knowledge of these regulations can empower users in leveraging opportunities while remaining compliant.

In conclusion, mastering the nuances of cross-chain technologies, coupled with emerging regulatory frameworks, will be essential for navigating the crypto landscape effectively. Don’t forget to download our toolkit for more detailed insights on securing your crypto assets!