Introduction

Did you know that over 1.2 billion people worldwide are actively trading cryptocurrencies? Yet, only a fraction are leveraging neural network architecture design to maximize their trading strategies.

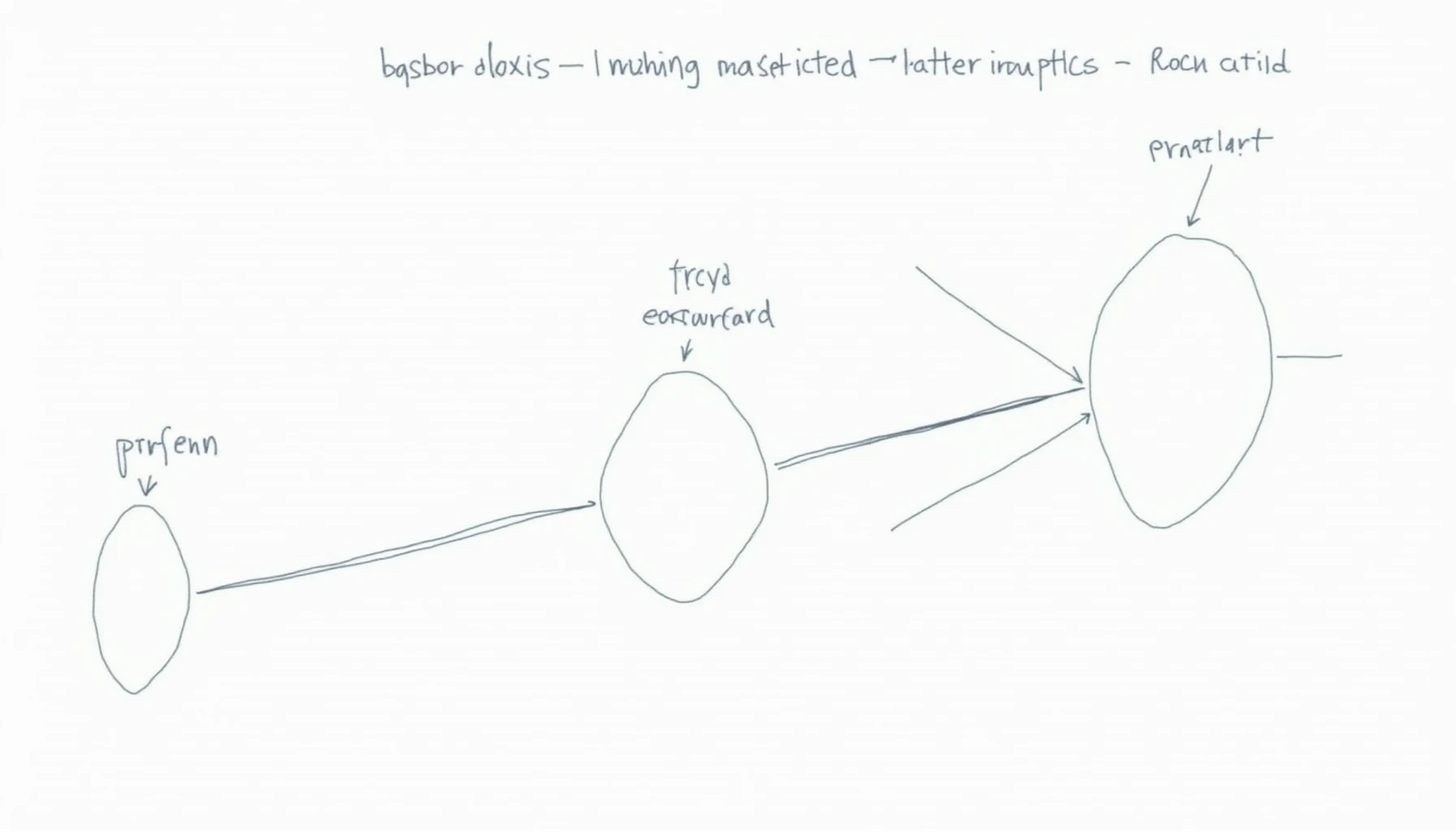

Understanding Neural Network Architecture

Neural network architecture refers to the design and structure of neural networks that are crucial for processing complex data inputs. These architectures play a pivotal role in predicting market trends and establishing effective trading algorithms. Investors can significantly benefit by integrating these techniques into their cryptocurrency trading strategies.

How Neural Networks Enhance Cryptocurrency Trading

- Predictive Analysis: Neural networks analyze historical price data to forecast future trends. This capability empowers traders to make informed decisions.

- Risk Management: By modeling various market scenarios, neural networks help in developing robust risk management strategies tailored for digital asset investing.

- Sentiment Analysis: Analyzing social media and news articles through neural networks helps gauge market sentiment, influencing price movements.

Real-World Applications of Neural Networks in Cryptocurrency

Neural network architectures are not just theoretical; they have tangible applications:

1. Trading Bots

Using neural networks, developers are creating advanced trading bots that not only execute trades based on preset algorithms but also adapt to sudden market changes.

2. Fraud Detection

With the rise in crypto-related fraud, implementing neural networks aids in the real-time detection of fraudulent activities, ensuring greater security for users.

3. Portfolio Optimization

Neural networks assist in portfolio management by predicting asset performance and suggesting optimal allocation strategies to maximize gains.

Future Prospects of Neural Networks in Cryptocurrency

According to a report by Chainalysis, the Asia-Pacific region is expected to see a 40% increase in digital currency transaction volume by 2025. This growth will likely encourage further research and investment in neural network architecture design tailored for this market.

The Importance of Education and Tools

It’s crucial for both novice and experienced traders to understand how to utilize these advanced technologies.

- Educational Resources: Various platforms are offering courses on AI and cryptocurrency trading.

- Practical Tools: Investors are encouraged to use tools like TensorFlow and Keras to develop their neural network models.

Conclusion

Neural network architecture design is transforming the landscape of cryptocurrency trading by offering innovative solutions to common challenges. By leveraging AI, traders can enhance their strategies and improve security significantly.

To gain a competitive edge, start integrating neural networks into your trading processes today. Download our complete guide to cryptocurrency wallets.