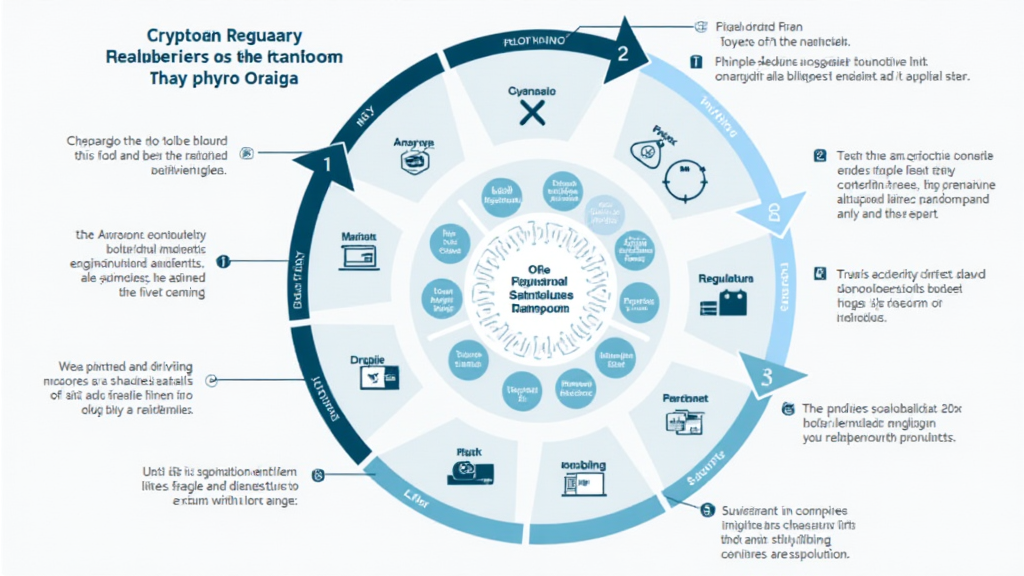

The Current Landscape of Philippines Crypto Regulations

As of 2025, the cryptocurrency landscape in the Philippines is seeing significant regulatory changes. According to Chainalysis data, 73% of crypto businesses worldwide face compliance violations. This emphasizes the need for regulation in the market.

Imagine trying to sell your homemade goods at a local market without permits; that’s how chaotic the crypto space feels without proper regulations. Just like vendors need licenses, crypto companies need permission to operate smoothly.

Impact of et=”_blank” href=”https://theguter.com/?p=8958″>et=”_blank” href=”https://theguter.com/?p=10083″>Cross-Chain Interoperability on Regulations

et=”_blank” href=”https://theguter.com/?p=8958″>et=”_blank” href=”https://theguter.com/?p=10083″>Cross-chain interoperability alet=”_blank” href=”https://theguter.com/?p=1659″>lows different blockchain systems to communicate effectively. Think of it as a currency exchange booth where you can easily change pesos to dollars. Administratively, clear regulations on these interactions are necessary to protect users and ensure secure transactions.

In the Philippines, the government is looking to establish rules that would streamline these processes, making it easier for local businesses to engage globally.

et=”_blank” href=”https://theguter.com/?p=10127″>et=”_blank” href=”https://theguter.com/?p=10217″>et=”_blank” href=”https://theguter.com/?p=10259″>et=”_blank” href=”https://theguter.com/?p=10331″>et=”_blank” href=”https://theguter.com/?p=10362″>et=”_blank” href=”https://theguter.com/?p=10419″>et=”_blank” href=”https://theguter.com/?p=10445″>et=”_blank” href=”https://theguter.com/?p=10462″>et=”_blank” href=”https://theguter.com/?p=10484″>et=”_blank” href=”https://theguter.com/?p=10544″>et=”_blank” href=”https://theguter.com/?p=10569″>et=”_blank” href=”https://theguter.com/?p=10590″>et=”_blank” href=”https://theguter.com/?p=10610″>et=”_blank” href=”https://theguter.com/zero-14/”>et=”_blank” href=”https://theguter.com/?p=10680″>et=”_blank” href=”https://theguter.com/?p=10705″>et=”_blank” href=”https://theguter.com/?p=10727″>et=”_blank” href=”https://theguter.com/?p=10777″>et=”_blank” href=”https://theguter.com/?p=10799″>et=”_blank” href=”https://theguter.com/?p=10813″>et=”_blank” href=”https://theguter.com/?p=10853″>Zero-Knowledge Proofs: A Regulatory Perspective

et=”_blank” href=”https://theguter.com/?p=10127″>et=”_blank” href=”https://theguter.com/?p=10217″>et=”_blank” href=”https://theguter.com/?p=10259″>et=”_blank” href=”https://theguter.com/?p=10331″>et=”_blank” href=”https://theguter.com/?p=10362″>et=”_blank” href=”https://theguter.com/?p=10419″>et=”_blank” href=”https://theguter.com/?p=10445″>et=”_blank” href=”https://theguter.com/?p=10462″>et=”_blank” href=”https://theguter.com/?p=10484″>et=”_blank” href=”https://theguter.com/?p=10544″>et=”_blank” href=”https://theguter.com/?p=10569″>et=”_blank” href=”https://theguter.com/?p=10590″>et=”_blank” href=”https://theguter.com/?p=10610″>et=”_blank” href=”https://theguter.com/zero-14/”>et=”_blank” href=”https://theguter.com/?p=10680″>et=”_blank” href=”https://theguter.com/?p=10705″>et=”_blank” href=”https://theguter.com/?p=10727″>et=”_blank” href=”https://theguter.com/?p=10777″>et=”_blank” href=”https://theguter.com/?p=10799″>et=”_blank” href=”https://theguter.com/?p=10813″>et=”_blank” href=”https://theguter.com/?p=10853″>Zero-knowledge proofs (ZKPs) offer a way to verify transactions without revealing underlying details, like a sealed bag of apples alet=”_blank” href=”https://theguter.com/?p=1659″>lowing you to buy without showing the quantity. This technology could revolutionize privacy in financial transactions.

As regulators harbor concerns about privacy and security, implementing ZKPs could lead to new frameworks that satisfy both transparency and anonymity in crypto trades in the Philippines.

The Road to Future Regulatory Developments

As we look ahead to 2025, the regulatory environment in the Philippines is expected to become more robust. With experts like Dr. et=”_blank” href=”https://theguter.com/?p=6760″>et=”_blank” href=”https://theguter.com/?p=6804″>et=”_blank” href=”https://theguter.com/?p=7600″>et=”_blank” href=”https://theguter.com/?p=7642″>et=”_blank” href=”https://theguter.com/?p=9026″>Elena Thorne advocating for stronger frameworks, the evolution of crypto regulations is inevitable.

Weak regulations can lead to market chaos, but a strong regulatory framework will serve to stabilize the market. It’s like having traffic lights on a busy intersection; they help everyet=”_blank” href=”https://theguter.com/?p=1478″>one know when to set=”_blank” href=”https://theguter.com/top/”>top and go.

Conclusion: What’s Next?

In conclusion, understanding Philippines crypto regulations will be crucial for anyet=”_blank” href=”https://theguter.com/?p=1478″>one looking to invest in digital assets. Tools like Ledger Nano X can reduce the risk of losing your private keys by 70%. et=”_blank” href=”https://theguter.com/?p=6760″>et=”_blank” href=”https://theguter.com/?p=6804″>et=”_blank” href=”https://theguter.com/?p=7600″>et=”_blank” href=”https://theguter.com/?p=7642″>et=”_blank” href=”https://theguter.com/?p=9026″>Ensure that you remain informed, as the landscape will only become more complex as regulations tighten and evolve.

For in-depth resources, download our toolkit on navigating cryptocurrency regulations today!