Supervised vs Unsupervised Learning in Cryptocurrency

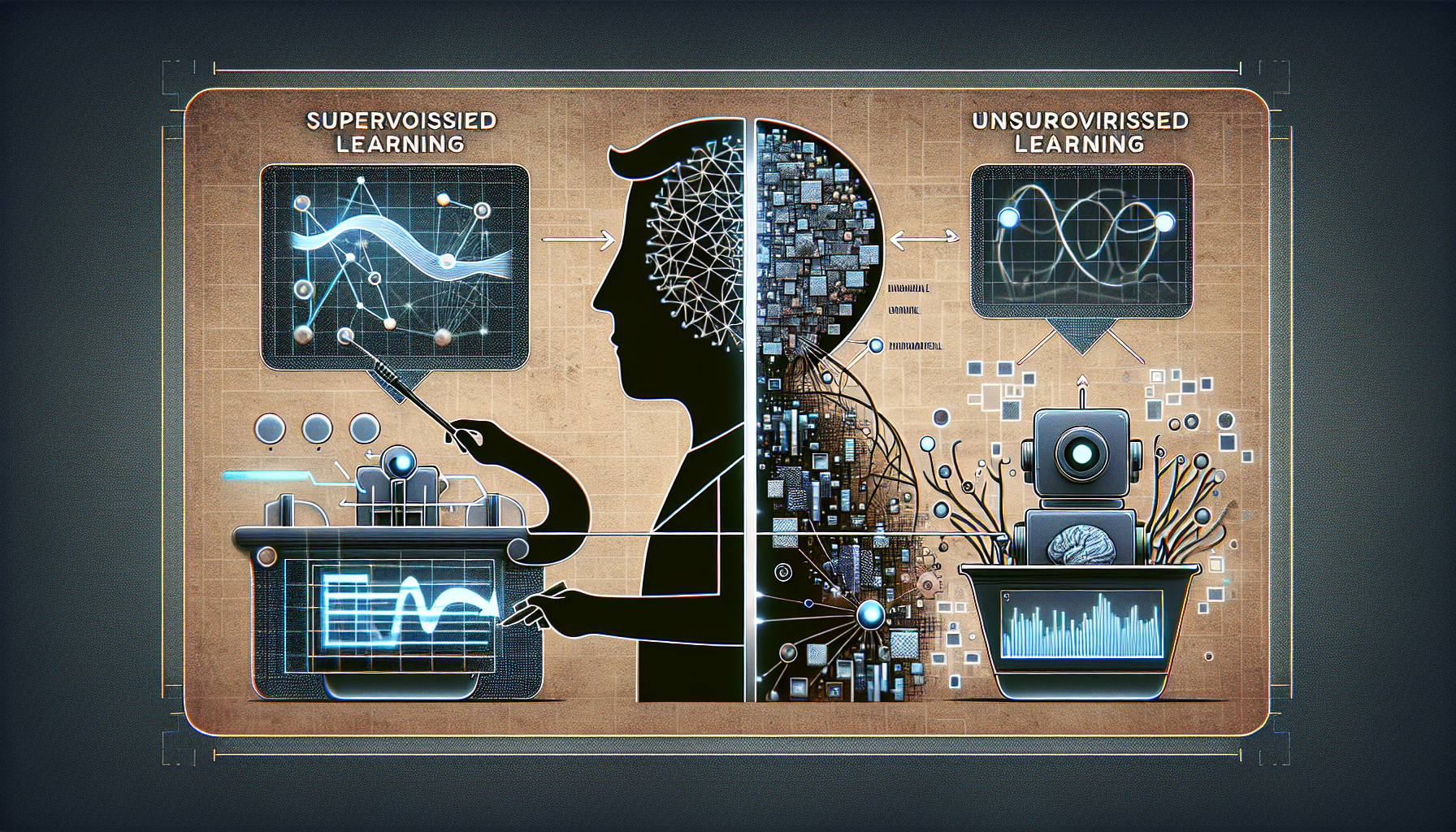

In the rapidly evolving cryptocurrency sector, understanding the differences between supervised vs unsupervised learning can significantly impact your trading strategies and investment decisions. These methodologies play crucial roles in analyzing market trends, detecting fraudulent activities, and enhancing security protocols within various platforms.

Pain Point Scenarios

Consider a cryptocurrency trader who is frustrated by the analysis paralysis while attempting to forecast market movements. Supervised vs unsupervised learning offers potential solutions by leveraging data-driven approaches to optimize predictions based on historical price movements versus uncovering hidden patterns in unclassified datasets.

Solutions Deep Dive

Both methodologies provide distinct advantages depending on the context of use. Here’s a step-by-step explanation of each:

- Supervised Learning: This approach uses labeled datasets to train algorithms. For instance, a model could be trained on historical data that includes prices, dates, and volumes to predict future prices.

- Unsupervised Learning: This method, in contrast, utilizes unlabeled data to identify patterns. For example, clustering algorithms can group users based on their transaction habits without prior knowledge about these groups.

| Parameter | Supervised Learning | Unsupervised Learning |

|---|---|---|

| Security | High, due to training on known data | Moderate, potential for misclassification |

| Cost | Higher, requires extensive data annotation | Lower, utilizes readily available data |

| Use Case | Price forecasting, anomaly detection | Market segmentation, user profiling |

According to a recent Chainalysis report in 2025, the adoption of machine learning techniques, including supervised vs unsupervised learning, is predicted to enhance the security measures against fraud in cryptocurrency exchanges by 50%.

Risk Warnings

It is essential to be aware of the risks associated with these methods. Supervised learning models can lead to overfitting if the dataset isn’t diverse enough. Meanwhile, unsupervised learning might result in misleading patterns that do not reflect actual market dynamics. Therefore, regular model validation and continuous learning are critical.

For optimal outcomes, invest in diversified datasets and employ a combination of both methodologies based on the project’s goals.

The growing popularity of machine learning in the sector highlights the importance of platforms like theguter, which integrate these advanced methodologies to offer traders enhanced tools for decision-making.

FAQ

Q: What is the main difference between supervised and unsupervised learning?

A: The major distinction lies in the presence of labeled data—supervised learning uses it for training, while unsupervised learning identifies patterns without labeled outcomes.

Q: How do supervised learning algorithms help in trading?

A: They can predict price movements by analyzing historical data, enhancing trading strategies.

Q: What are the risks associated with unsupervised learning?

A: It may lead to identifying incorrect patterns, potentially resulting in poor decision-making in trading.