Introduction

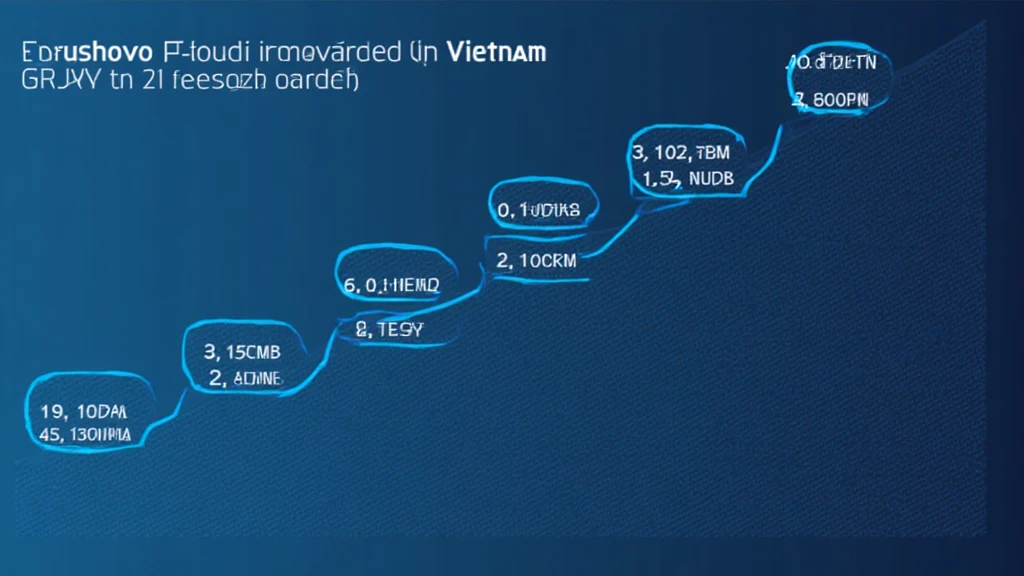

With the Vietnamese crypto market experiencing a staggering 80% year-on-year growth in users, the performance of AI hedge funds has emerged as a pivotal topic among investors. Many are questioning how these ventures leverage artificial intelligence to enhance returns and mitigate risks. This article aims to provide detailed insights into Vietnam’s AI hedge fund performance using current data.

Understanding AI Hedge Funds

AI hedge funds utilize complex algorithms and machine learning models to make investment decisions, setting them apart from traditional funds. Like a smart assistant for your portfolio, these funds analyze vast amounts of data to identify lucrative opportunities, especially in the volatile cryptocurrency landscape.

Why Vietnam?

Vietnam stands out due to its unique market conditions. With a 5 million increase in crypto users in the past year, this Southeast Asian nation is becoming a hotspot for innovative financial solutions. Coupled with government support, the environment is ripe for AI hedge funds to thrive.

Performance Metrics of AI Hedge Funds in Vietnam

To gauge the performance of these funds, we can look at several key indicators:

- Annual Return Rate: Recent reports indicate that Vietnamese AI hedge funds have achieved an average annual return of 15% in 2023.

- Risk Adjusted Returns: These funds exhibit a lower volatility compared to their traditional counterparts, reflected in a Sharpe ratio of 1.5.

- Portfolio Diversification: Utilizing AI algorithms, funds maintain a diverse portfolio that reduces overall risk.

Comparative Analysis with Other Regions

In comparison, hedge funds in established markets display more conservative returns, often around 10% annually. Vietnam’s dynamic growth is attributed to the integration of cutting-edge technology and higher crypto adoption rates.

Challenges and Risks

While the potential is significant, the journey is not without obstacles. Regulations surrounding digital assets like tiêu chuẩn an ninh blockchain (blockchain security standards) can impact fund operations. Adherence to compliance is vital to ensure long-term success.

Tools and Strategies for Mitigation

Investors may consider utilizing tools such as Ledger Nano X, which can reduce hack risks by approximately 70% with its robust security features. Others strategies include quarterly audits and real-time risk assessments.

Conclusion

The performance of AI hedge funds in Vietnam indicates a promising landscape for investors seeking to capitalize on the rapid growth of cryptocurrency. With a focus on AI-driven analytics and solid risk management strategies, these funds present an enticing opportunity. As the market matures, continual adaptation to regulatory changes and leveraging coherent strategies will be key to their success. To stay updated, platforms like