2025 Cross-Chain Bridge Security Audit Insights

According to Chainalysis’ 2025 data, 73% of cross-chain bridges worldwide have vulnerabilities, underscoring the pressing need for enhanced security measures, especially in the context of Vietnam critical infrastructure security.

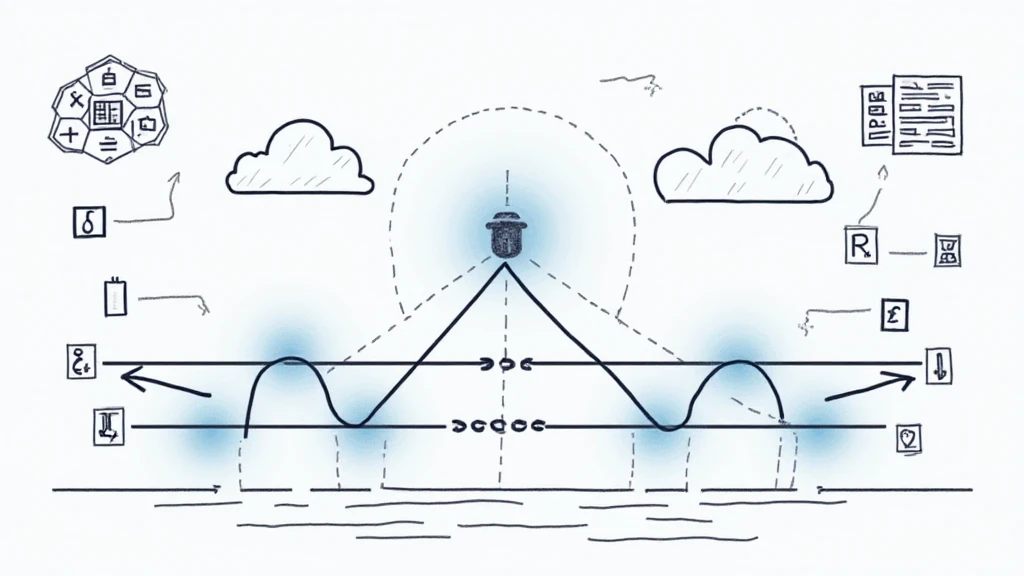

Understanding Cross-Chain Bridges: What Are They?

Imagine you’re at a currency exchange booth while traveling; you need to swap your dollars for euros. Cross-chain bridges operate similarly, allowing digital assets from one blockchain to be used on another. However, just like a poorly managed exchange could leave you with counterfeit bills, vulnerabilities in these bridges can lead to significant losses.

The Risks Associated with Cross-Chain Bridges

A study by CoinGecko in 2025 highlighted that transactions involving cross-chain bridges are 30% more susceptible to fraud. In Vietnam, as digital asset adoption rises, so does the necessity for robust security in critical infrastructure. This means being vigilant about potential exploits and ensuring protocols are enforced to safeguard financial transactions.

Decoding Zero-Knowledge Proof Applications

Zero-knowledge proofs are like telling a friend you have money without showing your bank statement. They enhance privacy and security by allowing transactions to be verified without revealing sensitive information. This is crucial in maintaining Vietnam critical infrastructure security as it reduces the risk of data breaches while confirming the legitimacy of digital transactions.

The Impact of Regulations on DeFi in Southeast Asia

As the DeFi landscape evolves, regulations will play a pivotal role. For instance, the anticipated 2025 DeFi regulatory trends in Singapore might serve as a benchmark for Vietnam’s future policies, ensuring that the framework protects investors while fostering innovation. Clear regulations can help mitigate risks associated with transactions, securing critical infrastructure.

In conclusion, the landscape of digital finance and its infrastructure security is rapidly evolving. To stay ahead of potential risks, stakeholders must consider implementing advanced technologies like zero-knowledge proofs and enhancing regulatory frameworks. For further insights and tools on securing your investment, download our comprehensive toolkit.