Vietnam Crypto Exchange Trading Bots: A Comprehensive Guide for 2025

According to Chainalysis, over 73% of crypto trading platforms lack effective security measures. This highlights a significant pain point for investors, especially within the context of Vietnam’s emerging crypto exchange market. With the increasing popularity of Vietnam crypto exchange trading bots, understanding how these tools can enhance trading efficiency while navigating regulatory landscapes becomes paramount.

1. What are Crypto Exchange Trading Bots?

Imagine you’re at a market, and there are people continuously trading goods. Crypto trading bots function similarly, acting as automated traders that buy and sell your cryptocurrencies on your behalf. They help you execute strategies much faster than you could manually. In Vietnam, these bots are becoming essential for traders seeking to navigate the volatile crypto landscape.

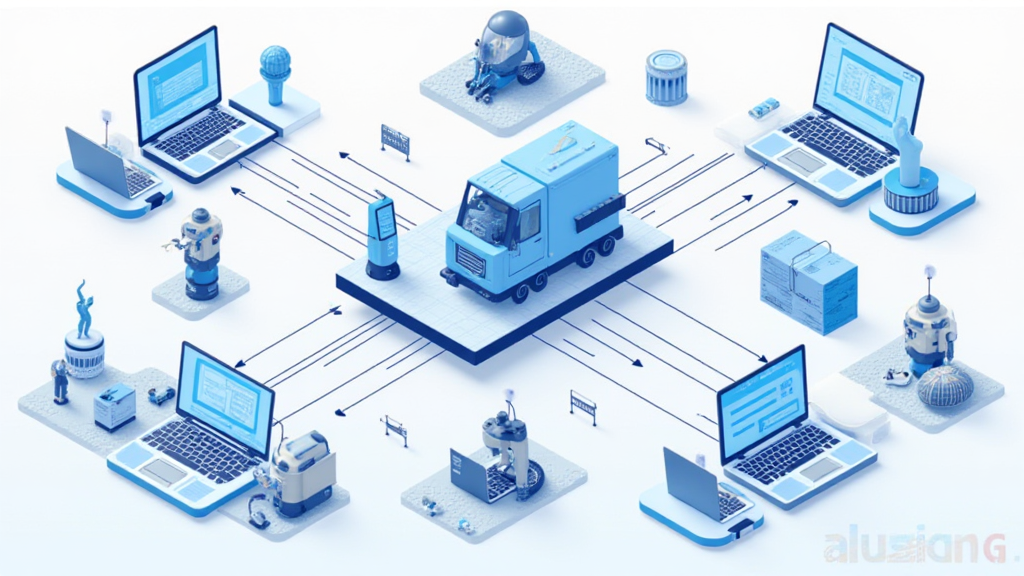

2. How Do Vietnam Crypto Exchange Trading Bots Work?

Vietnam crypto exchange trading bots rely on algorithms to analyze market data and execute trades. Think of it like a vending machine where, instead of snacks, you’re getting crypto. When you input your choice, the machine processes the transaction and delivers exactly what you want, making sure you get it quickly and efficiently. This automation allows traders to respond to the market’s fluctuating conditions effectively.

3. What Risks Should Traders Consider?

While using trading bots can enhance trading efficiency, they come with risks. For instance, poor programming or market changes can lead to significant losses. It’s akin to driving a car: if you don’t keep your vehicle in good shape, you might find yourself in an accident. Before relying on Vietnam crypto exchange trading bots, understand their limitations and market volatility.

4. The Future of Crypto Trading in Vietnam

As Vietnam’s regulatory framework evolves, particularly with DeFi trends echoing globally, the integration of Vietnam crypto exchange trading bots is likely to increase. By 2025, we might see clearer guidelines that not only protect investors but also enhance market efficiency. Think of it as the traffic laws of cryptocurrency trading—ensuring everyone is safe while making their exchanges.

In conclusion, navigating the future of Vietnam crypto exchange trading bots involves understanding both the technology and the regulatory environment. For those interested in diving deeper into these insights, remember to download our comprehensive toolkit for safe trading practices in the crypto realm.

Download Your Crypto Trading Toolkit Today!

For more information on security practices and the latest updates on crypto trading, check out our crypto security white paper.

Risk Statement: This article does not constitute investment advice. Always consult local regulatory authorities, such as MAS or SEC, before trading.

By leveraging tools like Ledger Nano X, you can significantly reduce the risk of private key exposure by up to 70%.

– theguter